Here’s Our Solution: US STEM Pathway for Global Accountants

For decades, the STEM track has been used by Techies to work in the US

Miles has used the same playbook

to recruit 1000s of Accountants

to work in the US

Traditional Master’s in

Accounting Program

(Non-STEM)

+

Data Analytics &

Information Systems

=

MS in Accounting

(STEM)

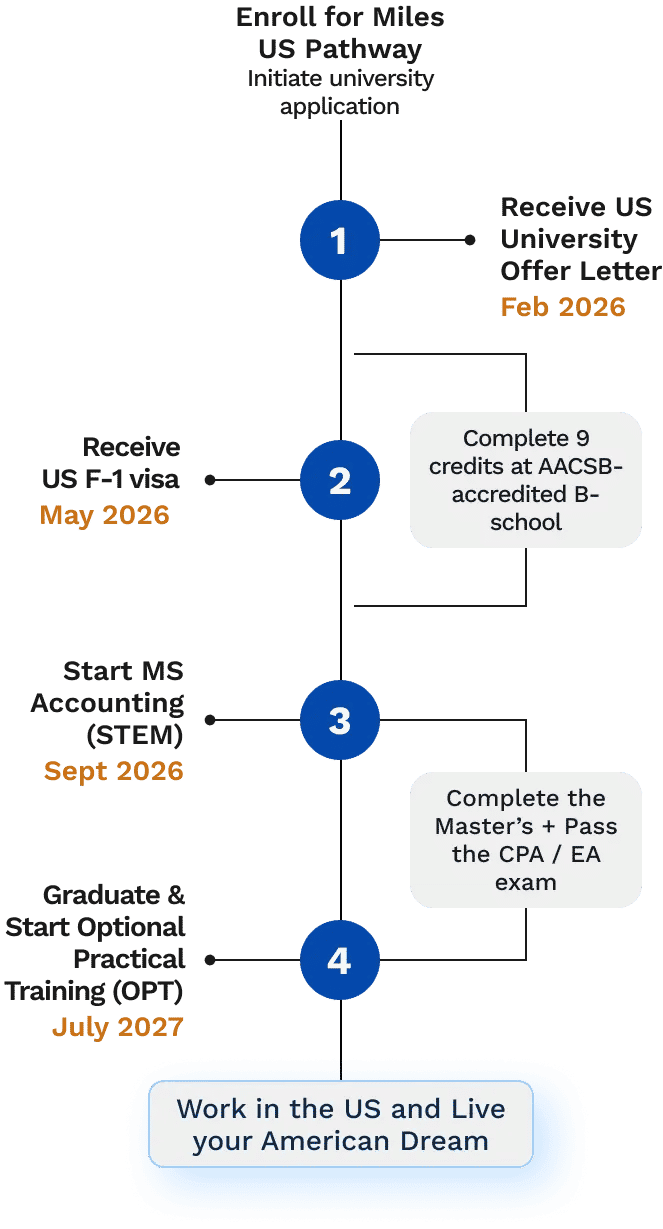

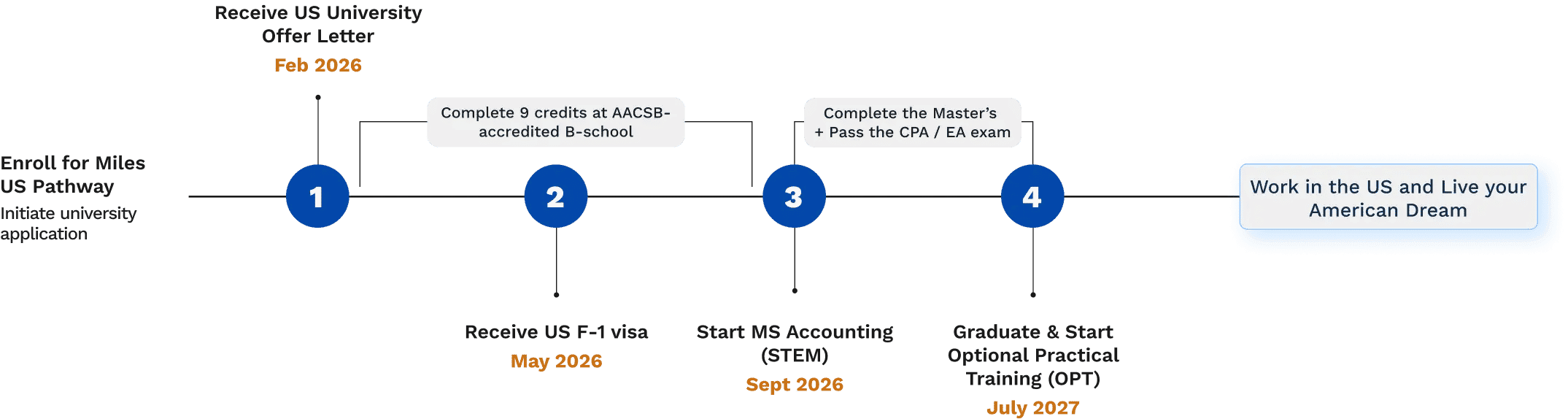

Timeline of your US Journey (Fall ‘26 Candidates)

Timeline of your US Journey

(Fall ‘26 Candidates)

Watch my story

Watch my story